Do we really need Life Insurance

From risks to your life and investment to your future retirement plans, life insurance has you covered.

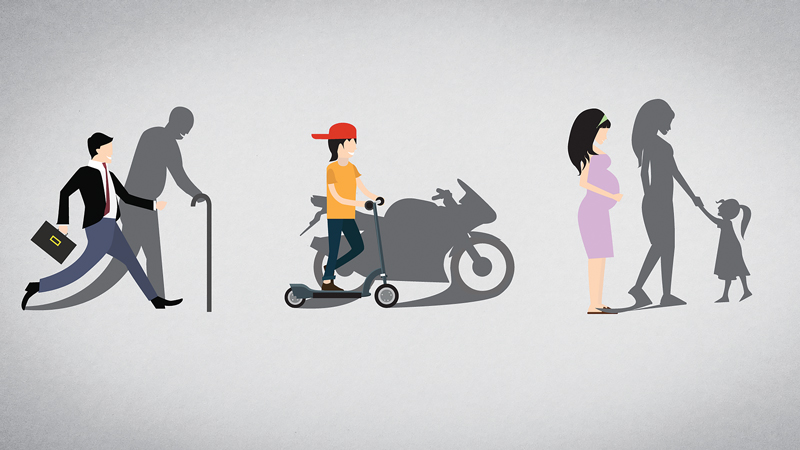

Life insurance policy is blanket policy for financial security and risk coverage against day to day uncertainty around us. Still, a lot of social taboo and negative connotations exists in Nepal with regards to life insurance like “Insurance le paisa didaina”, “Bhagya ma bhar parne ho”, “ commission ko lagi bhanyo hola” and so on. Inspite of all connotations, having life insurance is important to individuals, society and thereby economy as a whole for more secure and happier life. Here are 5 reasons to buy life insurance policy.

1. Better field for investment

If we look at the gloomy picture of market interest rate growth since last few years, people are losing money by saving into saving/fixed deposit account of banks and financial institutions. In regards with explicit interest rate of bank and financial institutions it seems pretty relatable to the bonus rate provided by life insurance companies. More specifically, ‘A’ class financial institutions are offering maximum interest rate of 5% on fixed deposit. If we really look about normal saving schemes, it’s even lower than this. Whereas, Insurance companies are offering minimum bonus rate of 6.5% p.a.

Given the situation on an average, the rate of return from insurance companies is greater than that of banks by almost 1.5% p.a. principally, it’s something unavoidable but could be managed and reduced to some extent through investing on life insurance policies.

2. Better source of Credit

Serving as a saving scheme is not the sole purpose of insurance; rather it serves as a good mechanism for facilitating loans and advances to manage liquidity needs.

Firstly, it can be sanctioned to policyholders initially after the completion of two payment periods if it is a yearly payment policy, but if it is a single payment policy, policyholders are entitled to get such facilities initially in the completion of one payment period. Here, the amount of credit would be up to 70% of the premium paid amount. Secondly, it can also be eased on the basis of surrender value too (i.e. up to 90% of surrender value). Lastly, the obvious benefit of loan against life insurance policy is hedging the policy itself as a collateral and easy loan processing within one working day, and talking about interest rate, it is 10% p.a. This does allow compounding. Hence, the effective interest rate is just 3.5% p.a. since the bonus rate is 6.5% p.a.

3. Endowed with riders

In addition to sand credit facilities, numbers of riders and additional benefits are listed as follows:

a) Accidental Death benefit (ADB)

It is also termed as accidental double benefit. As its name suggests, it provides the double amount of sum insured to the designated beneficiary of the policy. So, the financial needs of dependent could be taken care of. Hence, it’s recommended to have a substantial amount of life insurance policy especially in the family with single breadwinner.

b) Premium Waiver Benefit (PWB) and Permanent Total Disability (PTD):

These two riders are closely interrelated with each other. It means when the policyholder becomes permanently disabled and cannot generate cash anymore, then all upcoming premium will be waived off automatically. And all the benefits will be provided without any deductions at the end of maturity.

4. All uncontrollable risk coverage

With regard to the types of risks covered in life insurance policy, all personal and professional life risks that prevail and are associated in Nepal are covered except

- The airways services other than the regular flight authorized by the Civil Aviation Authority of Nepal.

- Any Kind of announced and unannounced war.

- Violation of civil law.

- Suicide of insure within 2 years of having insurance, irrespective of whether the person is insane or not.

5. Fulfills retirement needs:

If the policyholder until retires, the need for adequate retirement income should also consider. In Nepal most of the people are working outside the formal economy and government offices. So majority of people are not eligible for social security benefits like old age benefits and pensions. If you are not eligible for social security or if your retirement income is inadequate for fulfilling your future needs, then there are no alternatives rather than having sufficient amount of life insurance policy. You can obtain additional income from cash-value policy (normal life insurance policy) and retirement annuity.

Lastly, we can say that, very few people are insured. Statistically, out of total population only about 5-7% of people are insured and out of them 3% are under insured. So, what we can conclude is that, there is a very low level of awareness among people and life insurance is still not a priority for them. Here the fact is that even well educated and informed people try to avoid having life insurance policy.