Personal Finance Tracking A Mobile Way

Tracking your finance is the gateway to knowing what went where and how.

We are all avid spenders; some just have this innate ability to justify their purchases. The point of this article is not to turn you into a saving monster. It’s rather, to impart upon you the knowledge of financing so that you can be a better saver, investor and spender.

When it comes to money the majority of the populous find it difficult to know where their hard-earned money went. This seemingly unreal paradox is not a paradox at all; it's just a mix of one not tracking his/her expenses. Even if one is not an avid spender, they will run into a situation where they just seem to have misplaced a chunk of cash, which without having a good tracking system requires a time machine.

Personal financial tracking is a good habit to build, which tedious it might be but in the end develops a better understanding of one's spending habits, their disposable income and places where they can cut down their expenses and increase their savings. So the main question is how can one do it?

Step 1. Know where your money first comes from

If you have multiple sources of income, it might get tricky when money comes from all directions. Thus, tracking one's income is the first step to financial independence.

Prefer Account Deposits and Transfers

When you are to receive a payment for work done, request for your payments to be done through an account deposit or a fund transfer. This reduces the hassle for you to collect the cash, fight the urge to spend and have it be deposited.

Activate Credit/ Messages

A credit messaging service is provided by banks, which notifies the account holder of any transactions in the account. There is always mobile banking, but the messages sent to your cellular device does not require the internet. This would greatly help you know if the amount has been deposited and you can enter it into your app on the go.

Step 2. Where is your money going?

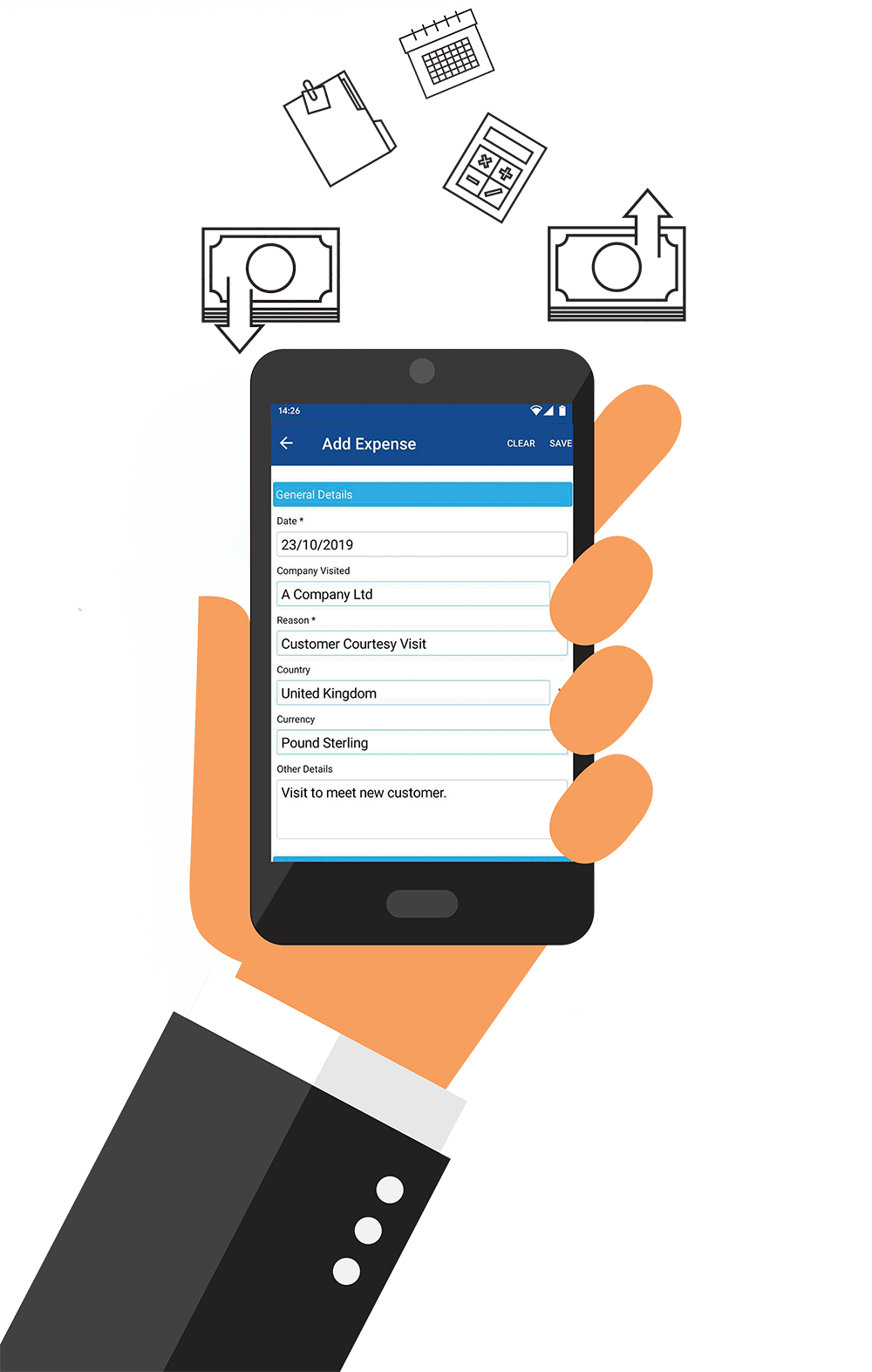

In today’s day and age, one doesn’t require a physical log book, which they have to carry around. One doesn’t need to have an entry every single time, one makes a purchase. The best direction to take is going mobile. Your phone can do more than just browse the web, and your app store is filled with more than just games.

Mentioned below are two of the best personal finance tracking apps for android and iOS, which can help you truly track your finances, and the million-dollar question.

Android

A. My Budget Book [$ 2.74]

An app that I have been using since I turned 18. If I have to sum up this app in 3 words; versatile, convenient, and utilitarian. The two dollars paid for the application is worth every penny as it allows one a simple and secure medium to log their basic expenses. One has the option of adding multiple accounts, which makes money management even easier. If you have the bucks to spare then this app, comes in high recommendations.

B. Money Manager Expense & Budget

Money Manager by Realbyte Inc. is the top-recommended application by the Play Store and is featured in the Editor’s Choice List. It shares almost the same functionalities as My Budget Book but because it is a free app, it contains advertisements. Removing advertisements can be paid for, which also gives access to PC Manager view, which in short allows one to take ones saving operation to their PCs.

iOS

A. Spendee

On iOS, Spendee is a great application to get your financial tracking journey started, trying to stand out from the rest by showing a detailed interface that is also easy to understand. This app shows your income and expenses in different colours depending on your type, sets objectives to save the amount, and includes social and location functions to add even more information to the records of your movements.

B. Xpense Tracker [$ 4.99]

Xpense Tracker allows you to manage your expenses for personal or business use efficiently. It has customizable categories and payment modes to ease your job. You can sort, as you like depending on your need according to payment type, category, client, or expenses by date.

The habit of tracking one's expenses is hard to keep, for having been doing this for more than 6 years myself. Still, occasionally I forget to push in those numbers, and you might forget too. But in all honesty, it's okay! The silver lining to tracking one's expenses is how one becomes aware of his/her spending habits. This awareness of how one has been spending their hard-earned money, on things they might not need helps them curve their expenses. In time, this leads to a better spending habit, which increases disposable income and thus becomes one’s savings.