Right Ways of Writing a Cheque!

It pays to know your way around writing a cheque.

Nepal is still a cash-based society, however use and acceptance of cheques is increasing day by day due to emergence of new technologies and changes in laws and regulations. A cheque book issued by your bank appears to be innocuous and simple. However, it’s really helpful to understand how to use cheques properly, and for that we need to understand what it can do and what are its features?

Features of a cheque

Firstly, let’s start with the features of a typical cheque and see what each section does:

- Date: write the date of the day you are writing the cheque

- Pay against this cheque to: write the name of the person or company/organization who you want to pay to or write ‘bearer’ if you are unsure who will actually visit the bank to cash the cheque. Writing ‘cash’ or ‘self’ is also OK if you are cashing your own cheque

- Amount in words

- Amount in figures

- Your signature must be inside the box

- Your name and account number is printed here by the bank

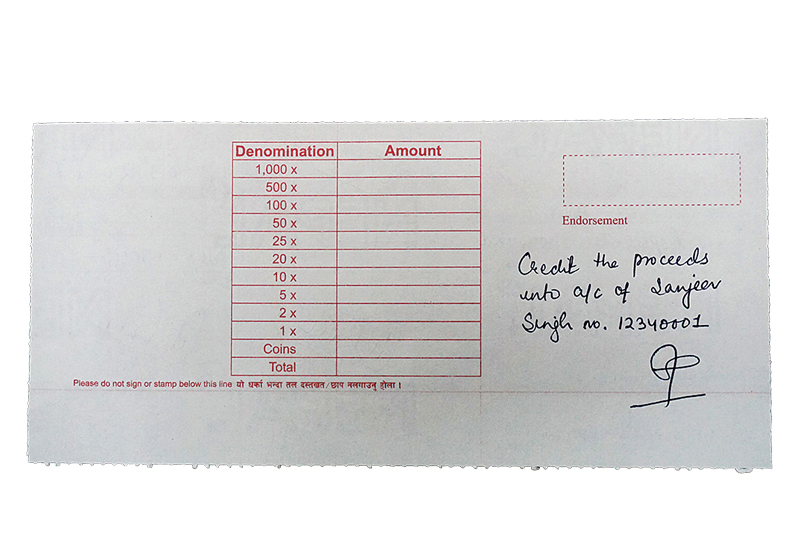

Reverse:

- Endorse here: this is the place where the person receiving the payment will sign

Why use a cheque?

When you write a cheque you are essentially instructing your bank to take money from your account and pay to the “payee” which could be yourself or another person or entity. Since such payments can also be made in cash instead of writing a cheque. You may wonder why we write cheque, which is not only time consuming but also inconvenient as compared to paying cash? But you are wise to write a cheque because:

- There will be always a recorded trail of your money outflow if payment is made through a cheque. This can help in disputes especially with third parties.

- Obviously it is extremely inconvenient to carry more than a certain amount around with you hence making a large value payment by way of cash is inconvenient not to mention risky. Any way, how big is your wallet or bag?

- If you want to release payment at a future date, you can write a post-dated cheque, i.e. you write the (future) date on the cheque in the “Date” section.

Avoid these common mistakes (and reduce risk of being a victim of fraud)

- Do not leave unnecessary space when writing the amount in ‘Words’ or ‘Figures’ for somebody else could add potentially words or numbers.

If unnecessary space is left, the words or figures can be unscrupulously changed by inserting some alphabet or number which will make the value of the cheque amount other than what you intended, for e.g.

Intended amount: NPR 7 .00 (Rupees Seven Only)

Altered to: NPR 70.00 (Rupees Seventy Only)

- To the extent possible issue only “Account Payee” cheques

Your transaction will be even more secure if you are in the habit of issuing Account Payee cheques because payment of such cheques can only be made into the account of the person or entity whose name appears in the “Pay to” section of the cheque. This is not negotiable and hence it is ensured that the person intended receives the money.This also means that an Account Payee cheque, even if lost or stolen, cannot be cashed by anyone else.

- Stop payment

If you lose a cheque or your entire cheque book, immediately inform your Bank and ask for the cheque(s) to be marked ‘Stop Payment.’ This will ensure that the lost or stolen cheque will not be cashed at the bank. You may be required to provide the specific cheque number so always note down the cheque number when you issue or write a cheque.

- Subscribe to ‘Transaction Alert’

Banks generally offer ‘Transaction Alert’ services these days. These alerts are received through SMS and/or your email every time money is deposited or taken out from your account. This helps early detection of frauds or mistakes and prevents further mishaps in the future (e.g. if you lose your cheque book and are unaware).

Understanding the difference between: Bearer, Order, & CO or Account Payee

- Bearer Cheque

Bearer cheque is almost like cash in the sense that proceeds of the cheque can be collected by anyone who presents it at the bank counter. Suppose, a cheque worth NPR 10,000.00 was issued in the name of “Ram” and given to him. However, he lost the cheuqe on his way to the bank. Now, the cheque is found by “Shyam” and he presents it to the bank’s counter. Bank will be required to pay to Shyam.

- Order Cheque

If you cross out the words Bearer (as illustrated below) the same cheque is now made to “Order.” This means your Bank will only pay to the person whose name is stated in the “Pay to” section and will seek proof of identity from that person before paying out the money.

Pay against this chequeto: Ram ------------------------------Or Bearer

Therefore, as is obvious an “Order” cheque is one step less riskier than a “Bearer” cheque in the sense of risk of payment to an unintended person.

- & CO

Although rare these days, you would issue an “& CO” cheque if you want the cheque to be paid into an account (any account) but not necessarily into the account of the person or entity named in the “Pay to” section. This is usually done in case the person you wish to pay by cheque does not have an account with any bank but you do not want the cheque to be cashed at a bank branch counter. “& CO” cheque will ensure that the money is first paid into an account (any account) before being withdrawn. This helps leave a record trail of where the money went from your account in case of future disputes.

- Account Payee

As discussed above, a cheque marked Account Payee can only be paid into the account of the person or entity whose name appears in the “Pay to” section of the cheque. This is not negotiable and thus is considered to be the safest (if not the most convenient) form of paying through a cheque.

Other points to note

- Cheques in Nepal are MICR (Magnetic Ink Character Recognition) based which have embedded security features. Therefore your signature(s) must be within the Signature Boxes otherwise there is a high chance your cheque will not be honored, especially through Electronic Cheque Clearing system.

- Electronic Cheque Clearing: If you issue a Cheque and the person receiving payment has account in another bank then such cheques get ‘cleared’ through the Electronic Cheque Clearing (ECC) system on the same day or next working day (if cheque is deposited in the bank after certain hours).

- Issuing a bad cheque, i.e. issuing a cheque without sufficient balance in your account is illegal. This can result in you being blacklisted (as per Nepal Rastra Bank regulations) or even imprisoned or fined or both (as per the Negotiable Instrument Act).

- Whenever Bank issues you a cheque book, a “Record Slip” page is also included. This is to be used for recording details of each cheque you issue. It is important that you maintain your records properly so that you can keep track of your finances, balances and also obtain information from the Bank in case of need in the future.

- Your signature will change over a period of time which is normal but your specimen signature in the bank’s record will always be as what you provided at the time of opening the account. If the signature differs between what the bank has in its record and on the cheque you issued, your cheque will not be honored. Please ensure that you update your signature as and when required to avoid such instances.

- As a general rule, banks will not honor a cheque if the amounts in Words and Figures are different. However, banks may at their discretion choose to accept and pay the amount written in Words (and disregard the amount in Figures).

- As per the prevailing laws of the country all payments over NPR 30 lakhs must be paid through Account Payee cheques. Paying by cash or even Bearer/Order/& CO cheques for such transactions is not legal.

- Finally, you can reduce your carbon footprint for banking by reducing use of paper (i.e. cheques) and opt for digital payments (internet or mobile banking, inter-bank payment services, account to account transfers etc). to the extent possible.